Michigan’s minimum wage laws are driven by state policies that align annual adjustments with inflation to ensure fair pay for workers. As we approach 2025, it’s crucial to understand the Michigan minimum wage for 2025, its projected rates, and how these changes will impact both employees and employers.

This post provides a comprehensive guide to the Michigan minimum wage, including its historical trends, exemptions, and best practices for compliance.

What Is the Minimum Wage in Michigan for 2025?

The Michigan minimum wage for 2025 is expected to rise to $11.50 per hour, a 3.60% increase from the 2024 rate of $11.10 per hour. For tipped workers, the base wage will increase to $4.92 per hour, with tips required to bring their total earnings to at least $11.50.

Michigan’s annual adjustments ensure wages reflect inflationary trends, protecting workers’ purchasing power while maintaining stability for businesses.

For official information, visit the Michigan Department of Labor and Economic Opportunity (LEO).

Historical Minimum Wage Data in Michigan

Michigan’s minimum wage history is closely tied to significant legislation and economic events that have shaped its trajectory. Over the years, Michigan’s wage policies have reflected both the state’s economic realities and national trends.

Key historical moments include:

- 2014 Legislative Action: Michigan’s minimum wage rose significantly after the Michigan Workforce Opportunity Wage Act was passed. This law set a schedule for incremental increases and linked future adjustments to inflation starting in 2019.

- The 2009 Recession Aftermath: Following the economic downturn, Michigan adopted policies aimed at stabilizing its workforce and addressing unemployment. Moderate wage increases during this period provided a buffer for workers.

- Inflation-Linked Adjustments (2019): The introduction of inflation-based adjustments marked a major shift in Michigan’s wage policy, ensuring consistent growth tied to economic conditions.

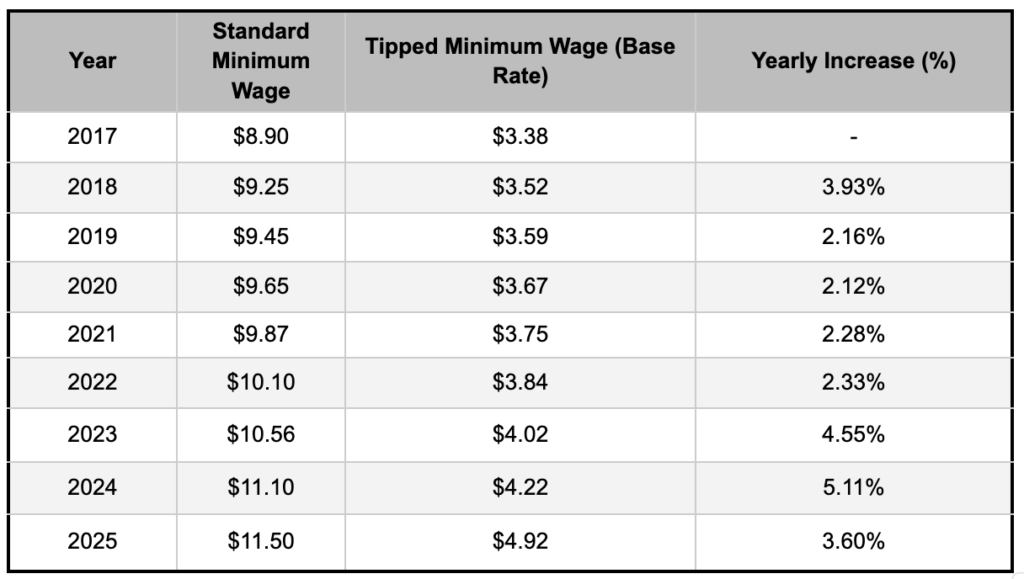

Here’s a detailed look at minimum wage trends from 2017 to 2025:

These changes reflect Michigan’s efforts to maintain economic balance while addressing the needs of its workforce.

Exemptions and Special Cases

Certain workers in Michigan are exempt from the state’s minimum wage laws or are subject to special provisions:

- Tipped Workers: Base wages for tipped employees will increase to $4.92 per hour in 2025, but total earnings (including tips) must meet or exceed $11.50.

- Youth Wage: Workers aged 16-19 may earn a training wage of $4.25 per hour during their first 90 days of employment.

- Small Businesses: Employers with fewer than two employees or annual gross receipts below $500,000 are exempt from Michigan’s minimum wage laws and must adhere to the federal rate of $7.25 per hour.

- Agricultural Workers: Some seasonal and farmworkers have specific wage provisions.

- Independent Contractors: Contractors are not covered under minimum wage laws as they are considered self-employed.

For detailed exemptions, visit the Michigan LEO Wage Laws Guide.

Who Oversees the Minimum Wage in Michigan?

The Michigan Department of Labor and Economic Opportunity (LEO) regulates and enforces the state’s minimum wage laws. Responsibilities include:

- Ensuring compliance with minimum wage and overtime laws.

- Investigating complaints from workers about wage violations.

- Assisting employers in understanding their legal obligations.

Employers must display the current minimum wage poster in a visible workplace location. Workers can file complaints with the LEO if they believe their wages do not meet the legal minimum.

Comparing Michigan’s Minimum Wage to Inflation

Michigan’s minimum wage is adjusted annually to account for inflation, ensuring that wages keep pace with rising costs. Between 2017 and 2025, the cumulative increase in Michigan’s minimum wage will reach 29.21%, slightly outpacing the U.S. compound inflation rate of 26.68% during the same period.

This steady growth protects workers’ purchasing power, though regional cost-of-living differences mean challenges persist, particularly in urban areas like Detroit.

Other Wage Laws in Michigan

In addition to the minimum wage, Michigan employers must comply with other labor laws that impact workers’ rights and compensation:

- Overtime Pay: Workers are entitled to 1.5 times their hourly rate for hours worked over 40 per week.

- Wage Theft Protections: Michigan law prohibits unauthorized deductions or withholding of wages.

- Recordkeeping Requirements: Employers must maintain payroll records for three years, documenting hours worked and wages paid.

- Youth Employment Laws: Specific rules govern the hours and conditions under which minors can work.

- Equal Pay Protections: Employers must ensure that employees performing similar work receive equal pay, regardless of gender.

For a full overview, visit the Michigan LEO Compliance Resources.

Impact of the 2025 Minimum Wage Increase

For Employers

Michigan employers, particularly in industries like hospitality and retail, must prepare for increased labor costs in 2025. Recommendations include:

- Reviewing and updating payroll systems to meet new requirements.

- Training HR and management teams to ensure compliance with wage laws.

- Budgeting for the financial impact of the wage increase, particularly for businesses with tipped employees.

For Workers

The wage increase to $11.50 per hour enhances financial security for Michigan’s workforce. Tipped employees benefit from a higher base rate, reducing their reliance on variable tips for financial stability.

How Michigan’s Minimum Wage Compares Nationally

In 2025, Michigan’s minimum wage of $11.50 will be significantly higher than the federal rate of $7.25 but lower than states with more aggressive policies, such as California ($16.50) and Washington ($16.58). However, Michigan’s inflation-tied adjustments offer a reliable framework for both workers and businesses.

Conclusion

The Michigan minimum wage for 2025 reflects the state’s commitment to fair pay and economic balance. With a projected rate of $11.50 per hour, Michigan ensures incremental wage growth that aligns with inflation and supports both employees and employers.

Staying informed about wage changes is critical for compliance and financial planning. For more details, visit the Michigan Department of Labor and Economic Opportunity.