Hawaii’s minimum wage laws are designed to address the challenges of living in one of the most expensive states in the U.S. Through legislation enacted in 2022, Hawaii committed to a phased approach to raising the minimum wage, culminating in a state-wide rate of $18.00 per hour by 2028. For 2025, understanding the Hawaii minimum wage and how it impacts workers and businesses is essential for compliance and financial planning.

This guide explores the Hawaii minimum wage for 2025, the historical context of wage increases, related labor laws, and what these changes mean for employees and employers.

What Is the Minimum Wage in Hawaii for 2025?

Since January 1, 2025, the Hawaii minimum wage is set to $14.00 per hour, up from $12.00 in 2024. This $2.00 jump reflects the state’s commitment to steady increases under its phased plan. For tipped employees, the minimum wage rises to $14.00 per hour as well, with a base rate of $12.50 per hour, provided tips bring their total earnings to at least $14.00.

Hawaii’s approach to wage increases ensures that workers across industries receive fair compensation while providing employers a predictable schedule for adjustments.

For official details, visit the Hawaii Department of Labor and Industrial Relations (DLIR).

The Historical Context of Hawaii Minimum Wage

Hawaii’s minimum wage history spans over 80 years, reflecting the state’s evolving economic needs. Key milestones include:

- 1942: The first minimum wage law established a rate of $0.30 per hour.

- 1970: The minimum wage increased to $1.60 per hour statewide.

- 2007: The rate rose to $7.25 per hour, aligning with the federal standard at the time.

- 2022: A significant increase to $12.00 per hour marked the start of the phased wage plan, designed to reach $18.00 by 2028.

Rising living costs and public demand for economic equity have driven these changes. Hawaii’s minimum wage has been adjusted more than 50 times since its inception, highlighting its critical role in supporting the workforce.

Multi-Tiered Minimum Wage System in Hawaii

Hawaii operates within a multi-tiered minimum wage framework, incorporating federal, state, and potentially local regulations:

- Federal Minimum Wage: Set at $7.25 per hour under the Fair Labor Standards Act (FLSA), this serves as a baseline but is far below Hawaii’s rates.

- State Minimum Wage: Hawaii’s state-level rates reflect its commitment to address its high cost of living and economic disparities.

- Municipal Minimum Wages: Although Hawaii does not currently have city-specific minimum wage ordinances, municipalities such as Honolulu may consider higher rates to reflect local living conditions in the future.

This tiered system ensures that workers in Hawaii earn wages reflecting regional and economic realities while meeting or exceeding federal standards.

Hawaii Minimum Wage Exemptions and Special Cases

Hawaii’s minimum wage laws include specific exemptions and special cases for workers in certain categories. Here are the key exemptions:

- Tipped Workers: Employers may count tips up to $1.50 per hour toward meeting the minimum wage, provided total earnings equal or exceed $14.00 per hour.

- Full-Time Students: Students working on campus in limited roles may qualify for reduced wages under certain conditions.

- Agricultural Workers: A special minimum rate of $10.50 per hour applies to eligible farmworkers.

- Apprentices and Learners: These individuals in certified training programs may earn temporarily reduced wages during the training period.

- Volunteers: Non-profit organization volunteers are not covered under standard minimum wage laws.

Comparing Hawaii’s Minimum Wage to Inflation

The Hawaii minimum wage has grown faster than inflation over the past decade, offering workers real wage increases. From 2017 to 2025, Hawaii’s minimum wage will have increased by 51.35%, while the U.S. compound inflation rate over the same period is approximately 26.68%.

This growth ensures that Hawaii workers maintain and even improve their purchasing power despite rising living costs. However, the high cost of housing, transportation, and imported goods in Hawaii means wages must continue to rise to meet the demands of daily life.

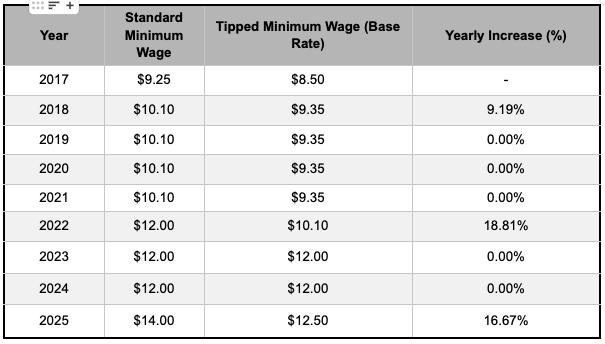

Historical Wage Data in Hawaii (2017–2025)

The largest increase occurred in 2022, when Hawaii began implementing its phased minimum wage plan.

Other Important Wage Laws in Hawaii

Hawaii’s wage laws extend beyond minimum wage rates to include:

- Overtime Pay: Most employees are entitled to 1.5 times their regular hourly rate for hours worked beyond 40 per week.

- Pay Transparency: Effective January 1, 2024, employers with 50+ employees must disclose salary ranges in job postings.

- Recordkeeping: Employers must maintain detailed payroll records for at least six years and provide employees with clear, itemized wage statements.

- Paid Sick Leave: Workers earn one hour of paid sick leave for every 40 hours worked, offering additional protections for employees.

Impact of the Hawaii Minimum Wage for 2025

For Employers

Businesses in Hawaii, particularly in hospitality, retail, and food service, must prepare for higher labor costs. Strategies to adapt include:

- Updating payroll systems and employee contracts to reflect the new rates.

- Streamlining operations to improve efficiency.

- Reassessing pricing to account for increased expenses.

For Workers

The wage increase to $14.00 per hour will provide much-needed financial relief, helping workers afford essentials like rent, food, and transportation in a state where these costs are among the highest in the U.S.

Why the 2025 Increase Matters

Hawaii’s minimum wage increase is not just about numbers—it’s about addressing economic equity, reducing poverty, and ensuring that workers can live with dignity in a high-cost state. By steadily increasing the minimum wage, Hawaii balances the needs of its workforce with the realities faced by businesses.

Conclusion

The Hawaii minimum wage for 2025 reflects the state’s ongoing efforts to support workers and address economic disparities. With a planned increase to $14.00 per hour, Hawaii ensures fairer compensation while paving the way toward its ultimate goal of $18.00 per hour by 2028.

For workers and employers alike, staying informed about these changes is critical for financial planning and compliance. Visit the Hawaii Department of Labor and Industrial Relations for the most up-to-date information.