Complete

Compliance

Management

SOC 2®, ISO 27001, risk analysis, and automated evidence collection from AWS & GitHub - all in one integrated platform built for modern organizations.

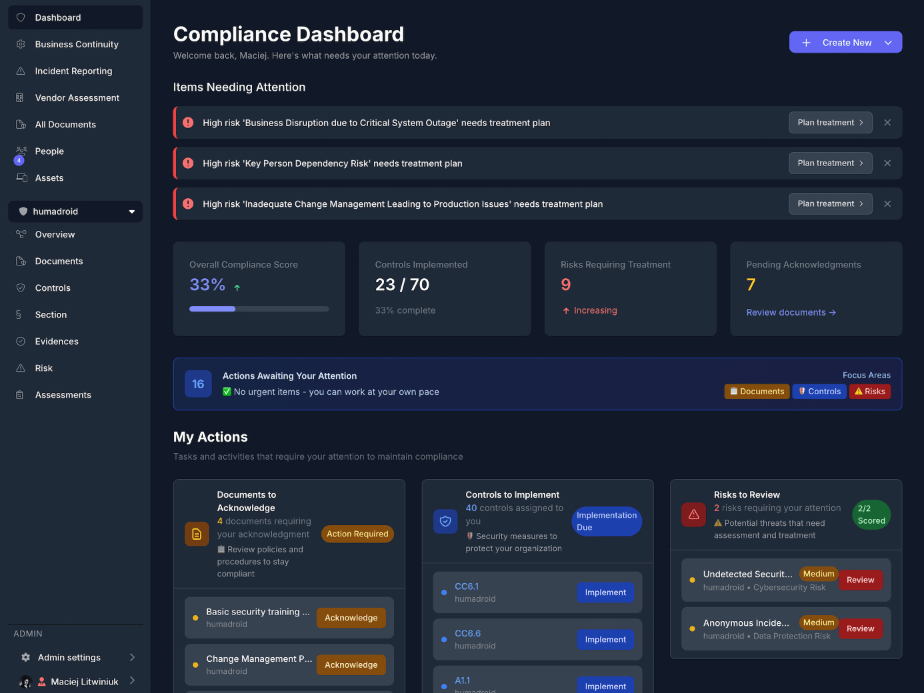

Compliance Dashboard

Revolutionizing Compliance

Through AI Innovation

Born from the frustration of $200k+ annual compliance consulting fees, Humadroid replaces expensive human consultants with AI that works 24/7. Get enterprise-grade compliance for 97% less than traditional consulting.

Our Story

Founded in 2024 by a team of compliance experts and AI engineers, Humadroid emerged from a simple observation: compliance shouldn't be a burden that slows down business growth.

After witnessing countless SMBs struggle with manual compliance processes, expensive consultants, and complex regulations, we knew there had to be a better way.

Today, our AI compliance assistant works around the clock for less than what most companies spend on a single consultant meeting, delivering instant expertise that never takes vacation or sick days.

Our Mission

To make compliance management accessible and affordable for SMBs, based on real implementation experience. No BS consulting speak - just practical tools that solve actual compliance problems.

Our Vision

A world where compliance enhances business operations rather than hindering them, powered by AI that understands your unique business needs.

Customer-Centric

Every feature is designed with our customers' success in mind.

Excellence

We strive for the highest standards in everything we do.

Innovation

Continuous innovation drives our AI-powered solutions.

Transparency

Clear, honest communication in all our interactions.

Complete Compliance

Management Suite

Everything you need to achieve enterprise-grade compliance without the enterprise-grade consulting bills. Our AI delivers expert-level guidance 24/7 at 97% less cost than traditional consultants.

SOC 2® & ISO 27001 Ready

Pre-configured frameworks with hierarchical control organization and implementation tracking.

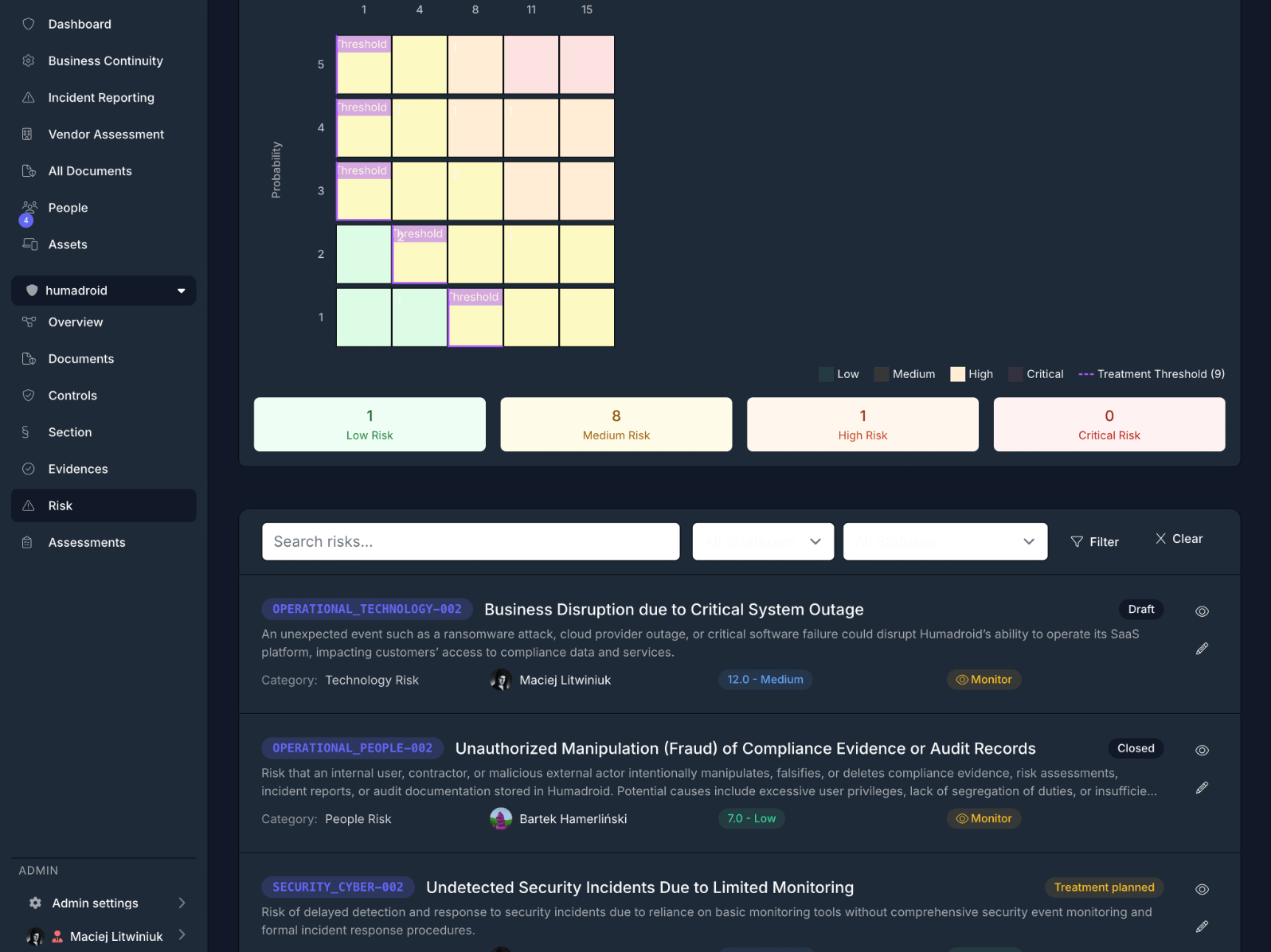

Advanced Risk Analysis

Multi-dimensional assessment across 8 impact categories with treatment planning and effectiveness mapping.

Business Continuity

Comprehensive BCP documentation with RTO/RPO tracking and crisis communication templates.

Incident Management

Complete incident lifecycle from logging to post-incident review with regulatory breach workflows.

Asset Management

Full lifecycle tracking from purchase to retirement with maintenance scheduling and depreciation.

Vendor Assessment

Risk tiering, assessment templates, and vendor portal for streamlined third-party management.

Trust Center

Public compliance portal at your custom domain. Share certifications and security posture with prospects instantly.

Automated Evidence Collection

Connect AWS and GitHub for continuous compliance monitoring. Evidence auto-collected and verified against SOC 2 & ISO 27001.

Multi-tenant Architecture

Enterprise-grade multi-tenancy with complete data isolation and role-based access controls.

Cloud-Native Infrastructure

Built on modern cloud infrastructure with automated scaling, backups, and 99.9% uptime SLA.

Enterprise Security

SOC 2® certified infrastructure with end-to-end encryption and advanced security monitoring.

Detailed Capabilities

Dive deeper into what makes Humadroid the complete compliance solution for your organization.

Compliance Management

- Control implementation tracking with responsible users

- Document versioning and user acknowledgments

- Evidence collection with attachment support

Risk & Continuity

- Point-in-time risk snapshots for audit evidence

- Critical process dependencies mapping

- Crisis communication and contact management

Incident & Assets

- Root cause analysis and corrective actions

- Physical asset lifecycle tracking

- Regulatory breach notification workflows

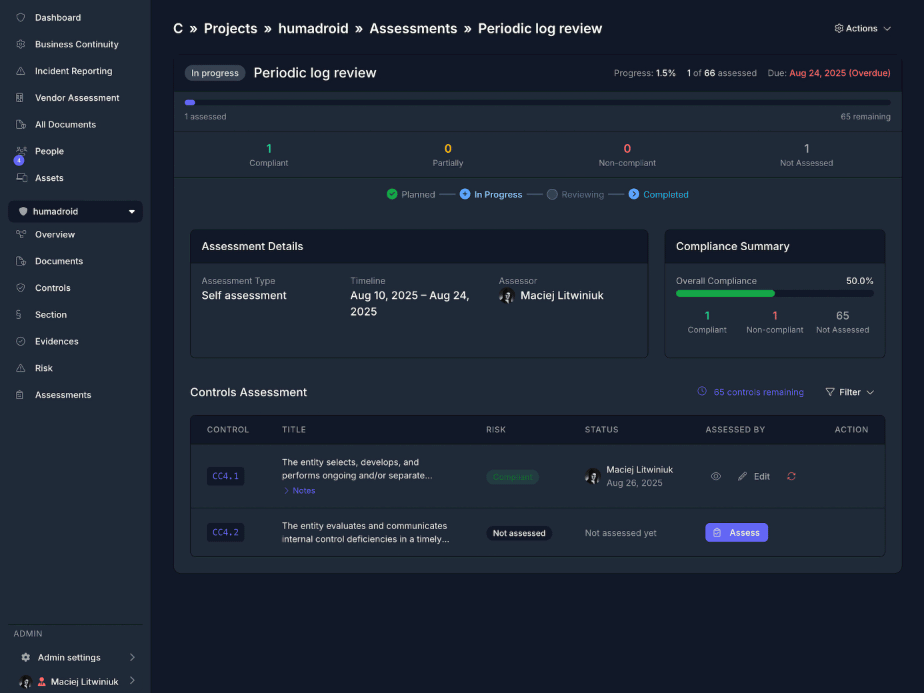

Experience Our Platform

Get a preview of our compliance management platform and see how it streamlines your workflow.

Compliance Dashboard

Comprehensive overview of your compliance status with real-time tracking of controls, risks, and audit progress.

Audit Management

Streamlined audit workflows with evidence collection, document management, and automated reporting.

Risk Assessment & Visualization

Advanced risk heat maps and assessment tools to identify, evaluate, and mitigate compliance risks across your organization.

Try Our AI Policy Generator

Completely Free

Experience Humadroid's AI-powered document generation. Get 3 professionally crafted compliance policies customized for your business in minutes.

AI-Powered Generation

Policies tailored to your company size, industry, and tech stack using Claude AI

3 Essential Policies

Information Security, Access Control, and Incident Response - ready in 5-10 minutes

Audit-Ready Format

Professional PDFs with proper structure for SOC 2® and ISO 27001 compliance

See the Power of AI Compliance Generation

No signup required. Just tell us about your company and get professionally generated policies in your inbox.

One Price,

Everything Included

No complex tiers or hidden fees. Get full access to all compliance management features with transparent, straightforward pricing.

Limited Time Beta Pricing

We're currently in beta! Get early access with special pricing and help shape the future of compliance management.

Get Compliant Faster

24/7 AI compliance expert that never sleeps, takes breaks, or charges hourly rates. Get enterprise-grade compliance for less than your current coffee budget.

Everything Included

Beta pricing available for limited time. Regular pricing $250/month after beta. Still 99% less than traditional consulting.

Beta Program Details

What's included in beta access?

24/7 AI compliance expert, complete access to all platform features, direct line to our development team, and the ability to influence product direction. Save $180k+ annually vs. traditional consultants.

How long is the beta period?

Beta access continues until our official launch. Beta users gain 50% lifetime discount

What happens to my data after beta?

All your compliance data, configurations, and workflows stays on the same, production platform.

Is there a commitment required?

No long-term contracts during beta. Help us build the best compliance platform while getting real value for your organization.

Trusted by Forward-Thinking Organizations

See how businesses are transforming their compliance operations with Humadroid.

"The automation capabilities have transformed our audit preparation. We can now demonstrate compliance across all our controls with just a few clicks."

"The risk assessment module is incredibly comprehensive. We can now track and manage risks across all impact categories with complete visibility."

"Business continuity planning has never been easier. The templates and RTO/RPO tracking help us stay prepared for any scenario."

"As a CTO at a growing fintech startup, I was skeptical about another compliance tool. But Humadroid genuinely understands what startups need - fast setup, smart automation, and no consultant overhead."

"Managing compliance across healthcare regulations seemed impossible for our 30-person team. Humadroid's AI made it manageable, almost easy. The risk assessment feature alone saved us countless hours."

"We've tried Vanta and Drata - both felt like enterprise tools crammed into our workflow. Humadroid is different. It's built for companies our size, with pricing that makes sense."

Trusted by companies across industries

Got Questions?

We Have Answers

Find answers to common questions about Humadroid's features, implementation, and how our AI-powered platform can transform your compliance management.

Still have questions? We're here to help.

Ready to Transform

Your Compliance?

Get started with a free consultation. Our compliance experts are here to help you understand how Humadroid can streamline your operations.

Send us a message

Fill out the form below and we'll get back to you within 24 hours.

Contact Information

8:00 AM - 7:00 PM CET

Schedule a Demo

See Humadroid in action with a personalized demo tailored to your business needs.

Quick Response Guarantee

We respond to all inquiries within 24 hours during business days. For urgent matters, please call us directly.