Florida is one of the few states actively raising its minimum wage in response to voter mandates and the rising cost of living. The Florida minimum wage for 2025 is set to increase to $14.00 per hour, continuing the state’s phased approach to reaching a $15.00 minimum wage by 2026. This upward adjustment ensures that workers in the Sunshine State benefit from higher earnings, but it also poses challenges for employers adapting to increased labor costs.

This post provides a comprehensive guide to the Florida minimum wage for 2025, its historical context, exemptions, and the broader implications for workers and businesses.

What Is the Minimum Wage in Florida for 2025?

The Florida minimum wage for 2025 will rise to $14.00 per hour on September 30, 2025, as part of a voter-approved constitutional amendment in 2020. For tipped employees, the minimum cash wage will increase to $11.00 per hour, with tips required to bring their total earnings to $14.00 per hour.

Florida’s minimum wage law exceeds the federal standard of $7.25 per hour, making it one of the most progressive wage policies in the southeastern United States. This increase reflects a statewide commitment to improving financial security for workers while supporting economic growth.

Historical Minimum Wage Data for Florida (2017–2025)

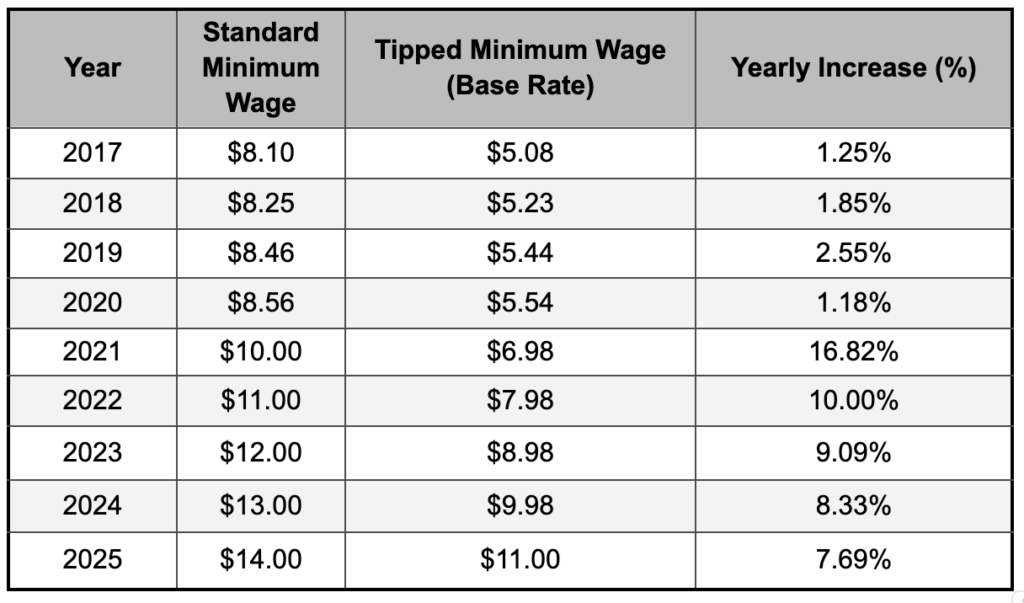

Florida’s minimum wage has steadily increased, driven by inflation adjustments and the constitutional amendment passed in 2020:

The significant jump in 2021 marked the beginning of Florida’s phased approach to achieving a $15.00 minimum wage by 2026.

Exemptions and Special Cases

While the minimum wage for 2025in Florida applies to most workers, there are specific exemptions and conditions for certain groups:

- Tipped Employees: Must earn a base wage of $11.00 per hour, with tips bringing total earnings to at least $14.00 per hour.

- Youth Wage: Workers under 20 may earn a training wage of $4.25 per hour during their first 90 days of employment.

- Independent Contractors: Excluded from minimum wage laws, as they are classified as self-employed.

- Small Business Exemptions: Some small businesses with gross revenue under a certain threshold may qualify for exemptions under federal law.

- Agricultural and Seasonal Workers: Specific exemptions apply based on federal and state guidelines.

For detailed information on these exemptions, visit the Florida Department of Economic Opportunity (DEO).

Who Oversees the Minimum Wage in Florida?

The Florida Department of Economic Opportunity (DEO) is responsible for enforcing the Florida minimum wage for 2025. This includes:

- Ensuring compliance with minimum wage laws.

- Investigating complaints from workers regarding wage violations.

- Issuing annual inflation-based adjustments to the minimum wage, as mandated by state law.

Employers are required to prominently display the updated minimum wage poster in the workplace. Employees who believe their rights have been violated can file complaints with the DEO.

Comparing Florida Minimum Wage to Inflation

The Florida minimum wage for 2025 is part of a planned increase designed to outpace inflation. From 2020 to 2025, the state’s minimum wage will have risen by 63.55%, significantly outpacing the U.S. compound inflation rate of 21.63% during the same period.

This proactive approach ensures that Florida workers maintain their purchasing power, even as the cost of living rises. However, regional variations in housing, transportation, and food costs mean that workers in urban areas like Miami and Orlando may still face affordability challenges.

Impact of the 2025 Minimum Wage on Workers and Employers

For Employers

Florida employers, particularly in industries such as hospitality, retail, and agriculture, face challenges in adjusting to the higher minimum wage. Key considerations include:

- Increased Labor Costs: Businesses may need to reevaluate pricing strategies to offset higher wages.

- Automation Trends: Some employers may invest in automation to reduce dependency on manual labor.

- Compliance Risks: Employers must ensure tipped employees meet the $14.00 per hour requirement or risk penalties.

For Workers

The Florida minimum wage for 2025 brings significant benefits for workers, especially those in low-wage industries:

- Enhanced Financial Security: A higher minimum wage helps workers afford essentials such as rent, groceries, and healthcare.

- Stabilized Income for Tipped Workers: The increase in the tipped minimum wage provides more predictable earnings, reducing reliance on fluctuating tips.

How Florida Minimum Wage Compares Nationally

IIn 2025, Florida’s minimum wage of $14.00 per hour will place it at 8th place for minimum wage rates nationwide. This rate is substantially higher than the federal minimum wage of $7.25 per hour and far ahead of many southeastern states, which have lower wage standards or follow the federal rate.

Comparison to the Highest and Lowest Minimum Wages

- Washington’s minimum wage in 2025 will be $16.58. Florida’s minimum wage will trail Washington’s by $2.58 per hour, highlighting the gap between the top-tier states and Florida’s phased-in approach.

- Georgia and Wyoming: These states have the lowest minimum wages, set at $5.15 per hour for some workers, though most employers must comply with the federal minimum of $7.25. Florida’s minimum wage will be nearly 3 times higher than Georgia’s and Wyoming’s base rates and nearly double the federal standard.

Florida’s phased approach to reaching $15.00 by 2026 reflects a balance between supporting workers and giving businesses time to adapt.

Conclusion

The Florida minimum wage for 2025 marks another step in the state’s journey toward a $15.00 minimum wage by 2026. With a rate of $14.00 per hour, Florida continues to lead wage reform in the southeastern U.S., providing workers with higher earnings while posing new challenges for employers.

Staying informed about these changes is essential for both employees and businesses. For more information, visit the Florida Department of Economic Opportunity.